Utilities need to be ready for the deluge of customer requests and the data to back up green programs and other emerging ESG compliance reporting requirements.

Environmental, social, and governance (ESG)-related regulations took huge leaps forward in 2023, and more regulatory progress is anticipated in 2024. The passing of a range of disclosure and reporting requirements in the European Union including the Corporate Sustainability Reporting Directive (CSRD), and the more recent passing of California Senate Bills (SB) 253 and 261 are requiring companies to get their houses in order regarding carbon and climate risk quickly. California has set the bar high, with its first required reporting due in 2026. Reporting requirements for local regulations like New York’s Local Law 97 and Boston’s Building Emissions Reduction Ordinance (BERDO) are also coming up quickly and Seattle passed similar legislation through the new Building Emissions Performance Standard (BEPS).

With the United States Securities Exchange and Commission’s (SEC’s) proposed rules on climate focused disclosures also targeted for release in Spring 2024, ESG reporting and in particular reporting on a company’s carbon footprint and climate-related financial risks have become a non-negotiable part of business.

As privately or publicly-held companies themselves, utilities have their own requirements in terms of reporting on the carbon emissions of their generation fleets, networks and other operations, as well as the supply chains that support them. But utilities’ ability to provide granular data to their customers on procured energy will be just as vital in proving out clean energy supply and supporting customer companies’ ability to satisfy compliance requirements.

New regulations: the state of play

While the SEC rules are still being finalized, the newCalifornia regulations have already set a powerful floor for companies doing business in California:

- The Climate Corporate Data Accountability Act (SB 253) will require public and private US businesses with revenues over $1 billion that do business in California to report their full scopes 1, 2, and 3 greenhouse gas emissions by 2027. The bill mandates third-party assurance on reported emissions starting in 2030.

- The Climate-Related Financial Risk Act (SB 261) will require large corporations to prepare and submit an annual report that publicly discloses their climate-related financial risks and the measures they’re taking to mitigate these risks. First reports are due in 2026, then biennially thereafter.

In Spring 2024, the SEC is poised to release its long-awaited final rules requiring climate-focused disclosures. Whether they initially include Scope 3 emissions, delay implementation of Scope 3 reporting, or leave Scope 3 out of their scope entirely, utilities and their customer companies will need data on their operational energy use and related carbon emissions. Note, the current proposed rule language does include Scope 3 requirements. If the SEC rules follow the California rules, disclosures will require third-party assurance – meaning that companies will need detailed, auditable data for verification, “showing their receipts” as it were.

Granular data acquisition/transparency must become the norm

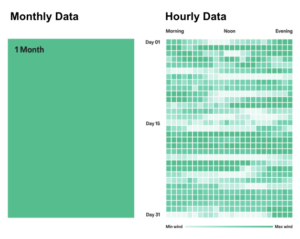

In the meantime, annual or simplified monthly reporting on energy and Renewable Energy Certificate (REC) supply will not be enough to satisfy customers’ reporting req uirements. Detailed reporting on procured energy and RECs matched to consumption will provide a sharper picture of companies’ facility carbon emissions and provide an audit-worthy base of data for eventual assurance needs.

uirements. Detailed reporting on procured energy and RECs matched to consumption will provide a sharper picture of companies’ facility carbon emissions and provide an audit-worthy base of data for eventual assurance needs.

Put simply: you can’t easily gather granular data after the fact. For customers on the receiving end of monthly bill or settlement data from the utility, it’s a very difficult task to reverse-engineer the needed emissions data and it will still lack precision.

That’s why providing timely, accurate, and granular data is increasingly important to utilities’ customers as they work to minimize compliance risk in the face of emerging regulatory drivers. But why is this a key risk for utility companies?

Allocation of energy and RECs among a diverse and large customer base is a detailed exercise often being managed manually via spreadsheets. Manual data management offers a range of opportunities for error or data corruption, as well as slowing down collation, access and analysis needed to supply that data in time for reporting requirements.

But utilities also have their own internal compliance requirements that will be happening in parallel – meeting state Renewable Portfolio Standard (RPS) reporting requirements, as well as supplying customers with proof of clean energy supply that can go beyond monthly settlement statements.

Granular data acquisition and greater transparency for customers has the potential to be a key customer benefit if utility IT teams can start the work now, getting the data infrastructure in place to serve customers’ needs and prepare them for eventual disclosures.

The SEC and California disclosure requirements are the starting gun

With the initial reporting deadlines for California SB 253 starting in 2026, forward-thinking utilities have the opportunity to invest now and start building the plans, assessing gaps in process and technology, mapping out the IT resources, and doing the longer-range planning to ensure the business is ready to meet core commercial and industrial customers’ compliance needs, as well as make the jobs of internal sustainability teams easier when they must prepare their own disclosures.

We’re here to help

Cleartace’s platform has already been working to answer these challenges, which can enable your teams to focus on what’s critical. Please visit our website to learn more.

Connect with Nicole on LinkedIn to share any feedback, questions, or sustainability needs.