The Securities and Exchange Commision (SEC) voted today (March 6, 2024) to adopt a scaled-back version of its long-awaited proposed climate disclosure rule, formally titled “The Enhancement and Standardization of Climate-Related Disclosures for Investors.” The vote comes two years after the proposed rule’s draft language was released in March of 2022. The final rule, which will take effect 60 days following publication in the Federal Register, applies to all United States (US) based publicly traded companies.

What does the final rule require?

The adopted version of the rule includes material climate-related risk disclosure requirements, including climate-related targets and goals set by a company, oversight and governance processes, how risks were identified and the business model and strategy associated with climate risks, as well as how the company manages climate related risks. There are also provisions for greenhouse gas (GHG) quantification and disclosures for direct and indirect emissions, if material, from Large Accelerated Filers (LAFs) and Accelerated Filers (AFs), if not otherwise exempt. The rule also requires an assurance report for those subject to the Scope 1 and 2 requirements. Per the SEC, “material” means there’s a reasonably likely impact on business strategy, operational results, or financial condition.

What changed?

It’s important to note that the GHG disclosure portions of the final rule are scaled-back from the initial March 2022 proposal. The proposal applied Scope 1 and 2 quantification and disclosure requirements to all subject companies. It also included Scope 3 requirements, if material.

What has happened in the last two years since the proposal was published?

Upon publication of the draft, the original public comment period had to be extended due to a glitch and over 24,000 comments were submitted from corporates and individuals alike. There was significant pushback from lobbyists on the inclusion of Scope 3 disclosure requirements. The timeline for a vote continued to get extended – per a December 2023 release, the rulemaking was added to the SEC’s Spring 2024 agenda, culminating with today’s vote.

In tandem with the delays toward promulgation and the pushback on what a final rule might include, California released its Senate Bills (SB) 253 and 261, which includes more robust requirements for GHG and climate-related disclosures, including Scope 3 emissions with no option to opt out. Similarly, the European Union’s (EU) Corporate Sustainability Reporting Directive (CSRD) establishes robust requirements for climate and GHG disclosures. Despite the final SEC rule being scaled-back, the regulatory landscape globally is shifting to increased transparency and rigor with respect to disclosures and verification requirements.

Should a scaled-back SEC rule pause or delay your sustainability initiatives?

Lobbyists that were hoping to have the Scope 3 requirements removed from the proposed SEC rule likely embrace the version of the rule adopted by the SEC as a win. Based on chatter in the sustainability space amongst practitioners, many feel the less rigorous version of the rule is a crushing blow to progress.

However, the bottom line is that the promulgation of a climate-related regulation from the SEC is another signal that understanding your climate risks and your carbon footprint are increasingly expected as part of your business’ license to operate.

Per a recent report from Climate Impact Partners, 66% of the Fortune Global 500 companies have made significant climate commitments and 76% of Fortune Global 500 companies have reported on carbon emissions. Many companies are already voluntarily quantifying and disclosing their emissions in preparation for emerging, and evolving, regulatory drivers and in answer to rising stakeholder pressures.

Per data from CDP, supply-chain emissions (Scope 3) typically account for 11.4x operational emissions. As such, companies, including Amazon, Microsoft, Apple, and Walmart, are increasingly asking for emissions data from their suppliers as part of sustainable procurement strategies. While your company may not be facing a regulatory driver today, you may still have to disclose emissions to maintain contracts or keep stakeholders happy.

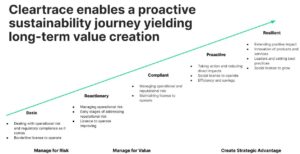

While the adopted SEC rule is less robust than initially proposed, companies that have not yet started quantifying emissions or taking climate action should not delay. Gathering data, particularly granular energy and emissions data, can take time and planning and it’s important to be proactive in this evolving sustainability landscape.

How can Cleartrace help?

No matter where you are on your sustainability journey, whether you are just getting started , or you are seeking to advance your progress and make traceable and transparent claims, Cleartrace is here to help with our solution offerings for quantifying and reporting of Scope 1 and Scope 2 GHG emissions, environmental attribute tracking, and more advanced initiatives like tracking 24/7 carbon free energy (CFE) and emissionality solutions.

Cleartace’s platform has already been working to answer these challenges, which can enable your teams to focus on what’s critical. Please visit our website to learn more.

Connect with Nicole on LinkedIn to share any feedback, questions, or sustainability needs.