Cleartrace has been on a journey both of discovery and growth, developing and deploying the market’s most sophisticated carbon accounting platform alongside key partners such as JPMorgan Chase. Today we took the next step in our evolution: announcing our latest round of strategic investment by ClearSky, Tenaska, EDF Energy North America, Brookfield Renewable, and Exelon. While we at Cleartrace are thrilled with this exciting news and industry validation, I am equally excited about what we’re building.

I spent the majority of my career in investment banking focusing on energy and commodities and the biggest gap I saw was the lack of data in the energy space. I watched incredible innovation happen in other sectors, while energy information was always several generations behind: siloed, linear, non-validated, and non-standardized.

I spent the majority of my career in investment banking focusing on energy and commodities and the biggest gap I saw was the lack of data in the energy space. I watched incredible innovation happen in other sectors, while energy information was always several generations behind: siloed, linear, non-validated, and non-standardized.

As climate action continues to rise as a global priority, carbon is becoming the biggest on-balance sheet liability for corporations. Solving the energy data access issue can enable those same corporations to bring critical insights to their energy procurement strategies and help them reach their net zero or clean energy adoption goals.

The urgency of energy and climate data access

There is a long history of regulation having massive impacts on financial markets starting with the founding of the SEC to end the Great Depression. History repeated itself during the Great Recession, as regulation ended risky lending practices associated with subprime loans. This pattern has happened every couple decades, and the recent SEC announcement is proof that this is starting to happen again.

Investors are already asking for more consistent, standardized carbon information. Shareholders are increasingly calling for companies to set strong carbon agendas and report out on their progress. They want to know how climate risk affects the companies they own and they want verifiable third-party data on how companies are lowering emissions to curb climate change.

According to Gary Gensler, Chairman of the SEC, “Investors representing trillions of dollars are looking for more consistent, comparable, & decision-useful info about the climate risk of the companies in which they invest… Disclosures should provide sufficient quantitative & qualitative detail so investors can gain helpful info. Generic boilerplate text doesn’t help investors.”

In addition, ESG reporting standards and frameworks – including those published by the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD), respectively – have been developed to provide investors with decision-useful disclosures on areas of energy and climate risk.

We are in the midst of another tidal wave of change, and this time it’s around climate risk – and the crux of that is energy data.

The end of lofty goals and self-reported averages

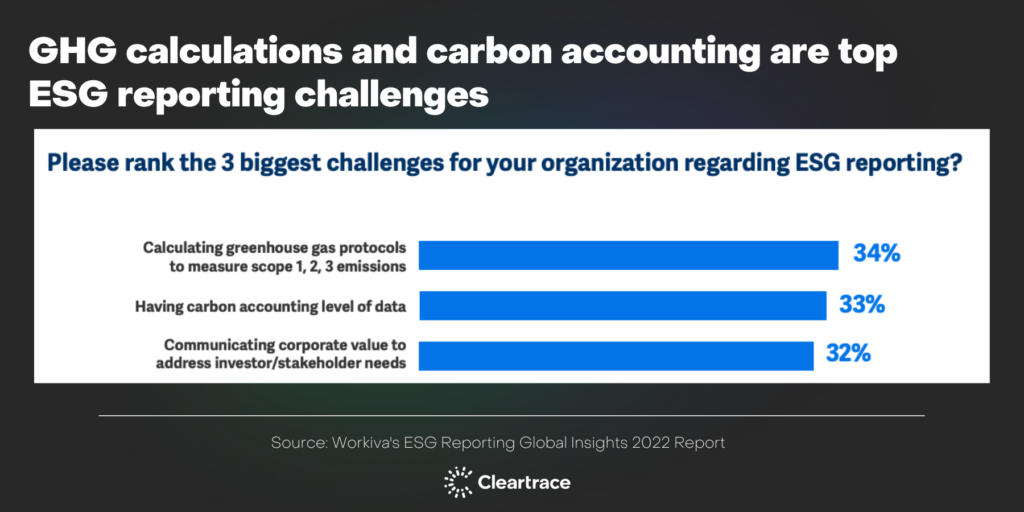

Just like financial statements – and more recently, ESG reporting following SASB or GRI standards – have to meet certain criteria, so will carbon emissions reporting. For carbon emitted from building operations (which account for 40% of global emissions), carbon will need to be traceable to meter-level sources of consumption and production. Workiva recently published a survey of issues facing 1,300 ESG professionals that found that “having carbon accounting level of data” was one of the top challenges facing companies today.

When a company claims to be “100% Renewable,” in many cases, what they’ve done is tallied up their carbon emissions for the year and purchased unbundled Renewable Energy Credits (RECs) to offset their emissions. The problem with that is that the sun doesn’t always shine and the wind doesn’t always blow, so they are in reality still emitting carbon, often in a different time and place than the offsets they purchased.

When you attempt to audit the data from this approach, and drill down into the months, days or even hours of energy production and consumption, the data is based on monthly averages that don’t provide visibility into what clean energy they are procuring and how it is offsetting their load. Not only can this open up the company up to accusations of greenwashing, but it also fails to deliver on the tangible progress promised by the company.

To that end, as data requirements increase, carbon emissions data will only be suitable for use by the world’s largest financial institutions if it is traceable, verifiable, and immutable.

Cleartrace provides the data needed to reduce carbon risk

That’s where we come in. We’re on a mission to help organizations understand and intelligently decarbonize their operations.

Cleartrace’s platform plugs into your existing reporting systems to illuminate previously hidden energy data and create a unified data layer for your company’s energy landscape. We reveal the hourly mix of the energy produced or consumed and provide immutable, auditable and assurance-ready proof of a corporation’s carbon footprint. Every hour, new, data-rich digital assets are created from the continuous stream of energy and environmental data feeding into our platform.

Cleartrace’s platform plugs into your existing reporting systems to illuminate previously hidden energy data and create a unified data layer for your company’s energy landscape. We reveal the hourly mix of the energy produced or consumed and provide immutable, auditable and assurance-ready proof of a corporation’s carbon footprint. Every hour, new, data-rich digital assets are created from the continuous stream of energy and environmental data feeding into our platform.

That data unlocks opportunities to not only help companies stand by their claims of renewable energy consumption, but also to proactively manage their decarbonization strategy and mitigate their climate risk.

Companies who embrace this will have a competitive advantage in the market. They will gain access to capital as investors increasingly favor companies that utilize transparent, third-party reporting. ESG and sustainability leaders will be able to better navigate ESG rating methodologies as they can provide proof of decarbonization efforts. Lastly, companies will also be better positioned in the face of increasing consumer preference for companies and products who are making sustainability a priority.

Welcome to the future of energy transparency

As we prepare to take the powerful tools we’ve developed further into the market, we want to thank every one of our customers, employees, partners, investors and advisors, and customers yet to come. We’re on a journey to empower organizations to understand and decarbonize their operations to reduce global emissions – and I hope you’ll join us.