The growth of markets and registries for Renewable Energy Certificates (REC) have enabled companies to book and claim large amounts of renewable energy (or simply the environmental attributes) in markets different than the ones they are operating in. For utilities and power producers, the creation and trading of RECs has created new challenges that requires detailed and consistent data: managing RECs for compliance purposes, such as state Renewable Portfolio Standards, and for utilities in particular, ensuring sufficient supply and allocation for renewable energy programs aimed at commercial and industrial customers, whose demand for renewable energy is growing daily.

In addition, the scale and breadth of transactions to manage varies widely–and will only grow as utilities increasingly grow the share of procured and owned renewable energy generation in their portfolios. Managing both compliance risk and customer risk is complicated and increasing, especially as utilities need to maintain data integrity with offerings spanning multiple REC registries.

Utilities and power producers need to plan for how they will manage allocations of RECs to ensure transparency and provide auditable data for their end-customers. Not putting robust reporting in place risks giving customers an inaccurate, or worse incomplete, picture of their carbon footprint from the electricity and RECs they source.

REC Allocation

RECs are traded using a “book and claim” system – where a sustainability claim made by a company is separated from the physical flow of the associated product, and can be sold “bundled” with the energy generated or “unbundled” (i.e., separately). One electron can’t be distinguished from another, so to solve this problem, book and claim systems were developed to allow customers to claim a specific amount of renewable energy and the environmental attributes associated with it. Electricity providers “book” the electricity they have produced in their systems and customers “claim” the environmental benefit of the energy (whether bundled or unbundled with the energy), receiving RECs to prove the purchase.

Utilities can own their generation or procure electricity from others. The more sources and customers they have, the more they need to be able to effectively track and allocate RECs generated from clean energy sources to the parties purchasing them.

At the moment, all RECs are treated as equal (e.g. 1 MWh attributes) even though RECs can have varying impact (e.g. additionality, avoided emissions, social/community benefits, etc.). Despite being the primary renewable energy instrument used across customer sustainability goals, the delivery of this information is typically in a PDF attestation that provides limited information, disconnected from customer consumption and carbon.

The “Slippery Fish” of the Decarbonization Puzzle

The growth of REC markets globally has provided a key additional revenue stream for renewable energy projects and provided a vehicle to trade the environmental characteristics of renewable energy. However, the wide range of available unbundled REC sources is turning REC procurement into a “slippery fish” – difficult to get your hands around – as an avenue for demonstrating environmental impact and supporting impactful renewable energy development. Without the ability to actively monitor and manage REC supply and allocation, utilities could find themselves in the position of racing to procure additional supply in wholesale markets to meet demand.

In addition, corporate appetite for renewable energy continues to grow, with many companies early in their journey that set the goal of sourcing renewable energy for their operations doing so through some (if not wholly through) purchase of RECs. As utilities scale up to meet corporate demand for RECs, tracking and allocation needs are scaling similarly.

The picture gets even more complex when renewable energy buyers become more sophisticated and set goals around purchasing RECs with greater impacts, like additionality or emissionality. While large corporations are growing their level of in-house expertise, smaller companies may not be at that maturity level, creating an opportunity for utilities to supply impact-focused RECs for their portfolios. This only increases the need for clarity and strong data about utilities’ REC inventory and the relative impact of each.

The challenge is that data is commonly managed across multiple different software systems and in spreadsheets, a cumbersome and typically manual process. This requires a great deal of data management and careful tracking to navigate both Renewable Portfolio/Energy Standards and customer voluntary purchases.

REC Management: The Latest Data Challenge Solved

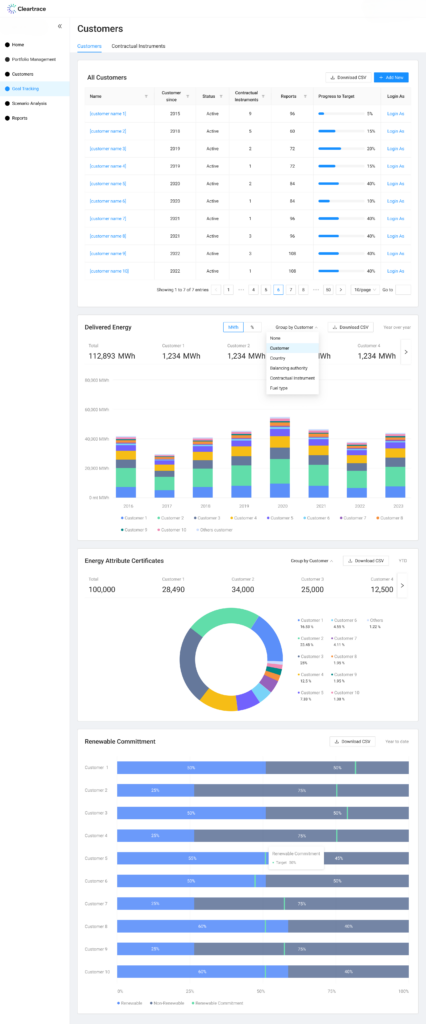

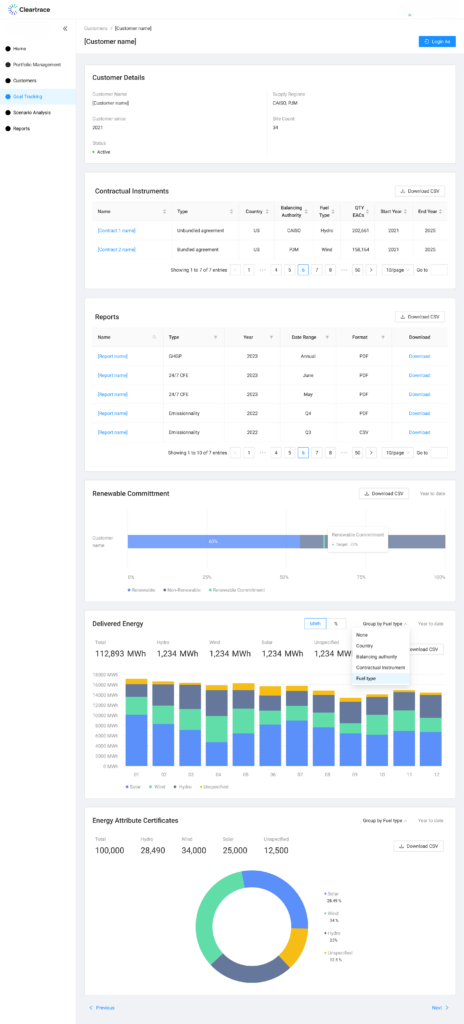

Managing REC inventories and allocation is the latest challenge Cleartrace has been helping utilities and gentailers tackle – providing a centralized platform for tracking generation and allocation of RECs to a growing range of corporate and industrial customers.

Our suite of software tools has been helping track granular energy generation and consumption based on best-available data and provide users with highly detailed reporting about their carbon impact. Today, we’ve expanded our offerings to help utilities and gentailers make their utility ensure their programs are robust and they have the data backbone they need to accurately track REC supply and allocation.

When you’re ready to take action on your decarbonization goals, connect with a Cleartrace expert. Book your Cleartrace demo today.